Keep For 6-7 Years

Just like businesses, it is important to keep your pay stubs until you are able to reconcile them with annual reports – that means you should keep your pay stubs for 6-7 years. It is important to keep records of your financial information, including pay stubs. Companies may require dozens of types of tax and support documentation for up to six years. If you are a business, keeping tax records for six or more years can take up space and costs may add up. Avoid surging document storage costs – work with Blue-Pencil today and consider off-site storage. Get a quote within 30 minutes for GTA’s award-winning document storage service.

How Long To Keep Pay Stubs In Canada

Canada Revenue Agency (CRA) states that when it comes to income tax records, you should keep all supporting documents for six years. Even if you do not need to attach certain records to your tax returns, it is still important to keep them on file in case of a review.

According to the CRA, during a review, they may even ask for unofficial documents such as canceled cheques or bank statements to serve as proof for any of any deduction or credit you have claimed.

Because it is so important to have all supporting documents on hand, many suggest you keep your pay stubs and other financial documents for seven years, just to be safe. The six-year period begins at the end of tax season and is based on your file date. If you file your tax return late, the six-year period also begins late! That’s why it is best to keep all supporting documents for seven years as a good rule of thumb (source).

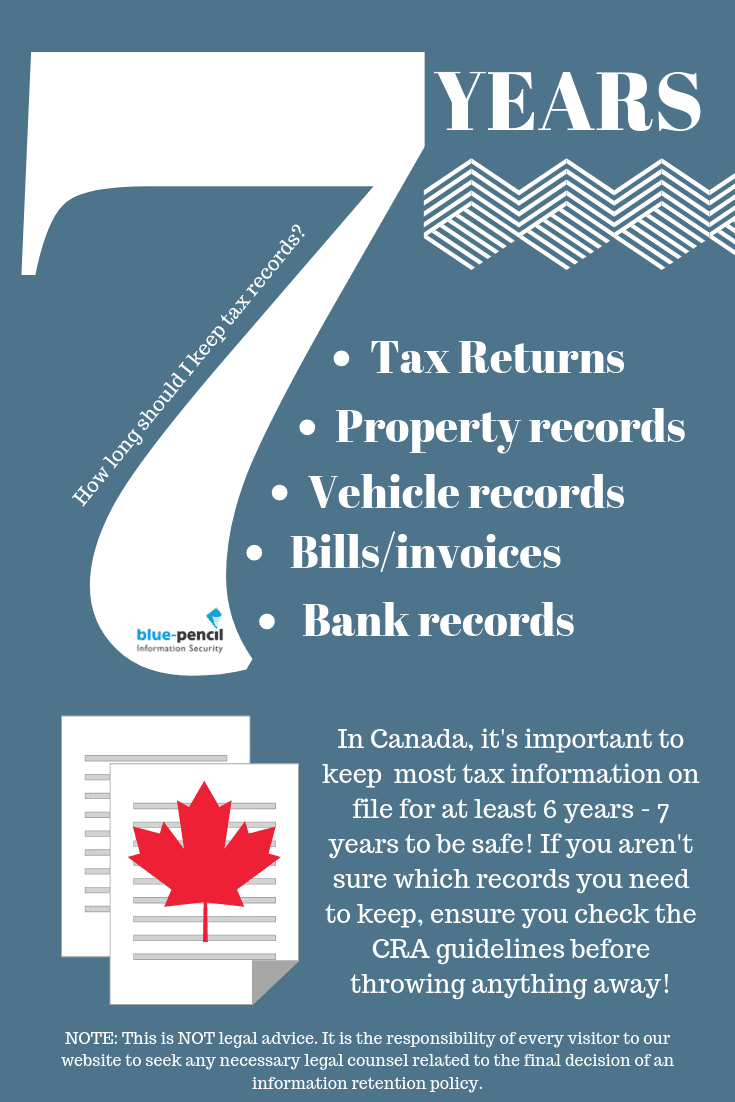

How Long To Keep Pay Stubs in Canada – An Infographic

Feel free to share this infographic or even print it out if you feel it would be helpful!

Keeping Pay Stubs – Information For Businesses

Knowing how long to store documents and employee records is very important in the workplace. Good organization is helpful for everyone and is also important when complying with government rules and regulations. Holding onto documents either too long or not long enough can actually end up costing businesses quite a lot. Here is what you need to know about keeping pay stubs and other important documents.

How Long To Keep Pay Stubs: Keep For 6-7 Years

It is important to keep employee pay stubs until you’re able to reconcile them with annual reports. After the six (or seven) year period is over, it should be safe to utilize a secure shredding solution to ensure confidentiality. Ensure pay stubs are stored in a secure location, as pay records are considered personal information. Read more about an employee’s right to privacy from the Office of the Privacy Commissioner of Canada here.

How To Keep Pay Stubs – Best Practices

According to the Ontario Ministry of Labour (MOL): “The Employment Standards Act (ESA) requires that employers keep written records about each employee for a certain time period. Records can either be kept by the employer or someone authorized to keep them on the employer’s behalf.”

It is important that employers keep pay stubs and other personal and financial employee information in an organized and secure manner. Only a select few authorized individuals should be able to access employee records. You may choose to keep pay stubs in both paper form and online, just in case something happens.

Where To Keep Pay Stubs

How can you ensure that both physical and computer copies of pay stubs and other records are secure? Using a records management service can help you stay organized and ensure sensitive information stays private.

If you choose to store your records on-site, it is best practice to store in a room or location that has limited access. You may also want to make sure that the storage location is fire-secure as well as protected from unwanted visitors.

Keeping Pay Stubs – Information For Personal Records Keeping

Keep Your Stubs For 6-7 Years

Just like businesses, it is important to keep your pay stubs until you are able to reconcile them with annual reports – that means you should keep your pay stubs for 6-7 years.

How To Keep Pay Stubs – Best Practices

Personal records keeping can be a challenge! Many people struggle to stay organized at home. This can make tax season feel like a complete nightmare. However, there are many methods of records keeping and personal organization that may help. Everyone is different, and it often takes a few tries before you feel satisfied with a new system. Check out this quick YouTube video below by Do It On A Dime that shows how simple it is to organize your important files!

- Will you likely need the document again as a reference?

- Are you obligated to keep this document on record in case the government or an official decides to review you?

When it comes to pay stubs, the answer to both those questions above is: yes! You can also use those general questions when it comes to other documents you are unsure about keeping or shredding. When trying to decide what to keep, remember that it is important to hold onto financial records.

Why should individuals hold on to pay stubs if their employer must keep pay records on file? It is important that both you and your employer keep track of these financial records. You need to report your income during tax season, and keeping your pay stubs organized will help ensure you avoid any potential problems, such as the “repeated failure to report income” penalty.

Where To Keep Pay Stubs

It may be a good idea to keep pay stubs and other important financial documents in a separate filing cabinet at home. If you prefer, you may even choose to buy a fireproof filing cabinet just to be extra safe. For extra security, buy a filing cabinet with a lock. There are many different types and styles of filing cabinets to suit every budget and personal preference.

Keeping Track of Important Documents

Whether you are an employee or a business owner, keeping financial records for six or more years can seem like a daunting task. There are do-it-yourself methods as well as organizations that will help make this task seem less overwhelming.

- Smartsheet – Free pay stub templates to help you keep track of your pay stubs as well as deductions, vacation time, and more.

- Meridian – Payroll management (must be a member)

- Blue-Pencil – Document and records management program to help store and keep your pay stubs organized

Keep Your Records Organized With Blue-Pencil!

Blue-Pencil empowers Canadian organizations to reach new heights with friendly and efficient document management services. Customer service is not only a slogan but something we practice by investing in our strategic partners.

Located in Oakville, we have grown our document security business over the past 10 years, serving more than 6,000 organizations including small and medium-sized companies as well as Fortune 500 businesses.

“They are reliable, friendly, courteous, and when it comes to empty our consoles, they are in and out so fast, you would never know they were here! We would recommend Blue-Pencil’s shredding to anyone.”

– Jason Ramsay – Read more testimonials here!

We have recently launched two new divisions; Documents Storage and Records Managementdivision and Document Imaging and Scanning Solutions division. This allows us to offer full circle, comprehensive solutions for information security management. We service the GTA and surrounding cities – click here for a full list of our service areas. If you’d like to learn more about us and what we can do for you contact us today!