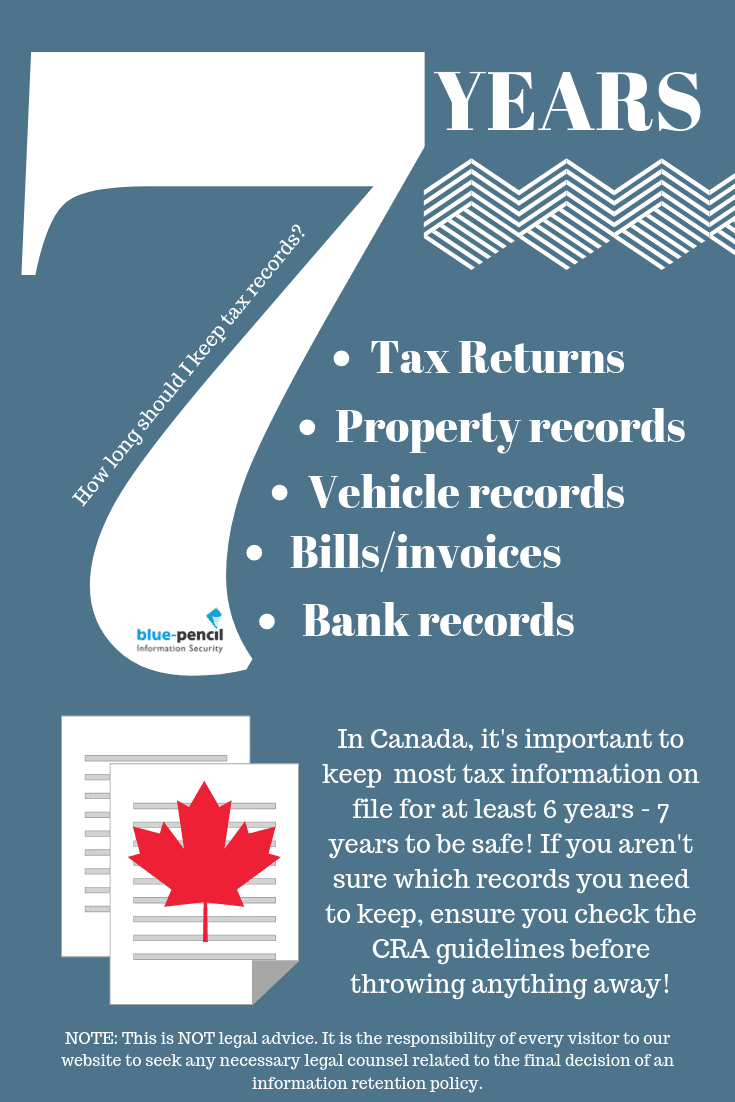

Have you ever wondered how long to keep tax records? For businesses, it’s incredibly important to know and understand how long you should hold on to different types of documents.

Holding on to records for too long will leave you with limited space for storage, while, on the other hand, if you have them shredded too soon you may lose important information that may be needed at a future date.

In this article, we’ll help you figure out how long to keep tax records on file, and which documents are worth keeping. Keep in mind that you should hold on to both an original copy and a scanned copy of all documentation in case of one becoming misplaced or being damaged. If you’re looking for some more information on document management or security you can click here to contact us today!

How Long To Keep Tax Records, Financial Statements & Business Documents

As previously stated, knowing how long to store your documents can be very important in the workplace. Holding on to them too long or not long enough can actually end up being quite costly. But there’s nothing to worry about, we’re here to help! Here are some of the most common workplace documents and our suggestions as to how long you should hold on to each of them.

Bills/Invoices: 6 Years to permanently

Bills and invoices can really pile up quickly in the workplace, but if you keep them well organized, holding onto them for up to six years should be sufficient. For any large purchases, you may want to consider storing the bills permanently in case you need proof of purchase for insurance purposes.

Bank Records: 1 Year or less to up to 6 years

Hold on to any of your deposit or withdrawal receipts until you receive your monthly statements to ensure that they balance. Hold on to your monthly statements for a longer period of time (6 years) but the rest of the small notes can be shredded.

Credit Card Statements: 1 Year or less

Once they’ve been checked and paid for there’s really not much reason to hold on to them any longer, but you may want to hold on to them long enough just in the case of an error that requires you to prove the bill has been paid. The general rule is one year.

Payroll Information: 1 Year

Hold on to your pay stubs until you’re able to reconcile them with your yearly reports. Once this is done it should be safe to shred them.

Tax returns: At least 6-7 years

According to the Canada Revenue Agency, a general rule of thumb for maintaining any tax related documents is 6 years from the end of the last year they relate to. There are, however, different situations where the expected retention period is either shorter or longer; those can be found here. Another important note is that you must keep all of your taxation records either at your place of business or your residence unless the CRA provides you with permission to do otherwise.

HR Data: 2-3 years

For HR data it really depends on a number of factors, but to be on the safe side we would suggest retaining these documents for 2-3 years before shredding.

Customer Information: Destroy once satisfied its purpose

There’s no real timeline for which you should retain customer information, but it should be held for a reasonable amount of time to allow a customer to obtain the information afterward. It is your duty as a business to follow PIPEDA’s guidelines, however, which state that any customer information must only be used for the purpose for which it was collected unless otherwise consented by the customer. Once you determine this period of reasonable time has passed, any customer information should be destroyed.

Loan Documents/Life-insurance policies/Vehicle title: Permanently

Documents like these should be retained permanently, or at least up until the items under which the loan was used for are no longer in your possession or the term for your life-insurance policy has run out.

Marketing/Sales Data: Permanently

There’s no legal requirement to hold on to these types of documents, but we would suggest holding on to them throughout the duration of your business so that they can be used as a reference if need be.

So why do we have to keep any documentation?

There are a few reasons that you’ll want to maintain some of the documentation that comes through your workplace. First of all, there are laws in place in regards to document retention that you must follow as a registered business. Outside of these retention laws, keeping a hold of some of your business records provides your company with a paper trail in the case of errors or a need for quick referencing.

Though many people choose to shred their documentation once having it backed up to a digital file, you should still maintain your hard copies in the case that your digital file is damaged or destroyed. In a nutshell, retaining your documentation is mostly about ensuring you and your employees are covered in case of any mistakes or errors. If you’d like to learn more about the document storage process or what storage options we have available to you here at Blue-Pencil, you can click here now!

Rely on Blue-Pencil to Keep Your Tax Records Safe!

Blue-Pencil is an information security company that has been serving the needs of clients in Canada since 2004. We have grown our document security business over the past 10 years, serving more than 6,000 organizations including small and medium-sized companies as well as Fortune 500 businesses.

We have recently launched two new divisions; Documents Storage and Records Management division and Document Imaging and Scanning Solutions division. This allows us to offer full circle, comprehensive solutions for information security management. We service the GTA and surrounding cities – click here for a full list of our service areas. If you’d like to learn more about us and what we can do for you contact us today!

Disclaimer: It is the responsibility of every visitor to our website to seek any necessary legal counsel related to the final decision of an information retention policy. Visitors agree to indemnify and hold harmless Blue-Pencil Inc. from any claims, loss, or damages arising from or in any way related to the tips or guidelines included in this article or for any reason.

Sources:

http://www.cra-arc.gc.ca/tx/bsnss/tpcs/kprc/rtntnl-eng.html

https://www.priv.gc.ca/resource/fs-fi/02_05_d_16_e.asp

http://www.consumerreports.org/cro/2010/03/conquer-the-paper-piles/index.htm

http://www.bankrate.com/finance/personal-finance/how-long-to-keep-financial-records.aspx